- UpRise Crowd's Newsletter

- Posts

- Mastering the Real Estate Market: Strategies for Investors Amid Interest Rate Fluctuations

Mastering the Real Estate Market: Strategies for Investors Amid Interest Rate Fluctuations

Interest rates play a significant role in shaping the real estate market, affecting everything from mortgage rates to property valuations. As an investor, understanding the implications of interest rate changes and adapting your strategies accordingly is crucial for long-term success. In this blog post, we'll explore some practical tips and advice to help you optimize your real estate investments amid interest rate fluctuations.

I. Understanding the impact of interest rates on the real estate market

A. Mortgage rates and property demand

Interest rates have a direct impact on mortgage rates, influencing the affordability of loans for potential homebuyers. Low-interest rates tend to increase demand for housing by making borrowing more affordable, while high-interest rates can reduce demand and slow down the market.

B. Property valuations

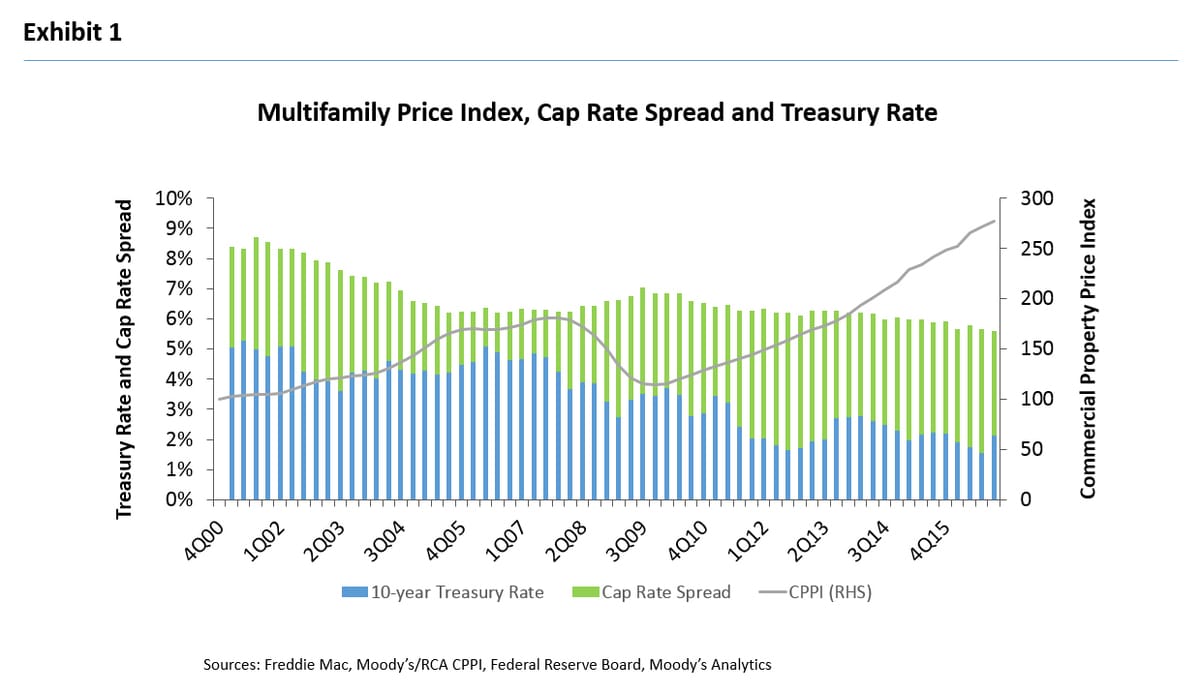

Interest rates also affect property valuations by influencing capitalization rates (cap rates). Changes in interest rates can lead to fluctuations in property values, making it essential for investors to stay informed and adapt their strategies accordingly.

II. Practical advice for real estate investors to optimize their investments

A. Diversify your investment portfolio

Diversification is key to managing risks associated with interest rate fluctuations. By investing in various property types, locations, and investment vehicles, you can mitigate potential losses and maximize your returns.

B. Consider fixed-rate and adjustable-rate mortgages

Weigh the pros and cons of fixed-rate and adjustable-rate mortgages to determine which option best suits your investment goals. Fixed-rate mortgages offer predictable payments, while adjustable-rate mortgages may provide lower initial rates but could increase over time. Assess your risk tolerance and investment horizon before deciding.

C. Monitor market trends and economic indicators

Stay informed about market trends, economic indicators, and interest rate forecasts to better anticipate changes in the real estate market. Regularly review data and reports from reputable sources like central banks, government agencies, and industry experts.

D. Reevaluate your investment strategy

As interest rates change, it's essential to reevaluate your investment strategy and adjust your approach to minimize risks and maximize returns. Be prepared to make data-driven decisions and adapt your strategy based on current market conditions.

E. Seek professional advice

Working with experienced financial advisors or real estate professionals can help you navigate interest rate fluctuations and optimize your investments. They can provide valuable insights, analyze market trends, and offer personalized advice tailored to your investment goals.

F. Explore alternative real estate investment options

Consider investing in real estate investment trusts (REITs), crowdfunding platforms, and private real estate funds to diversify your portfolio and potentially reduce interest rate risks. These investment vehicles can provide exposure to the real estate market without the need to manage individual properties directly.

III. Strategies for long-term success in the real estate market

A. Focus on cash flow

Positive cash flow is crucial for long-term success in real estate investing. Ensure that your investment properties generate consistent rental income, covering expenses, and providing a buffer for potential interest rate changes.

B. Invest in growth markets

Identify markets with strong growth potential, driven by factors like job growth, population growth, and infrastructure development. Investing in growth markets can help you benefit from property appreciation and secure higher rental income.

C. Prioritize quality over quantity

While it might be tempting to chase high returns by investing in multiple properties, focusing on quality investments is essential for long-term success. Look for properties with strong fundamentals, such as desirable locations, good neighborhoods, and solid construction.

Conclusion

Interest rate fluctuations are an inevitable part of the real estate market, but by staying informed, diversifying your portfolio, and working with professionals, you can optimize your investments and achieve long-term success. Remember that real estate investing is a marathon, not a sprint, and a well-thought-out strategy can help you navigate

Disclaimer: The information provided in this blog post is for general informational purposes only and should not be considered financial, legal, or investment advice. The author and publisher are not responsible for any actions taken based on the information provided. Consult with a financial, legal, or investment professional before making any decisions related to real estate investments or interest rate fluctuations.